-

The Ultimate Amazon Airbnb Setup Shopping List for New Investors As the short-term rental market continues to thrive, many investors are looking to capitalize on the growing demand for Airbnb listings. Whether you’re a seasoned investor or a first-time host, setting up your property efficiently can

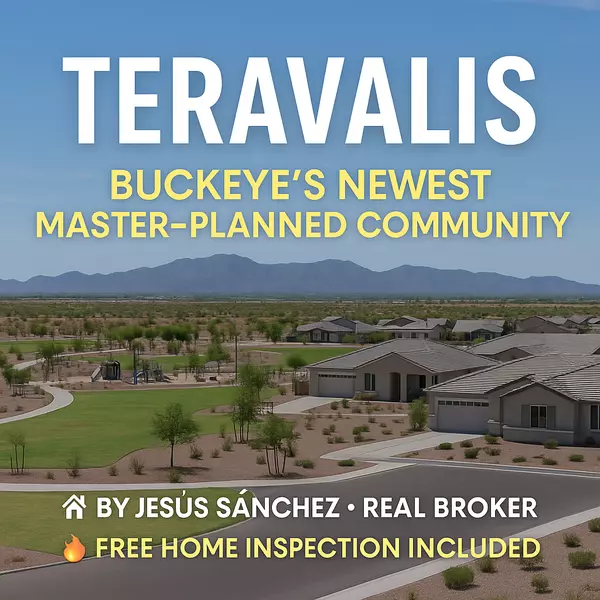

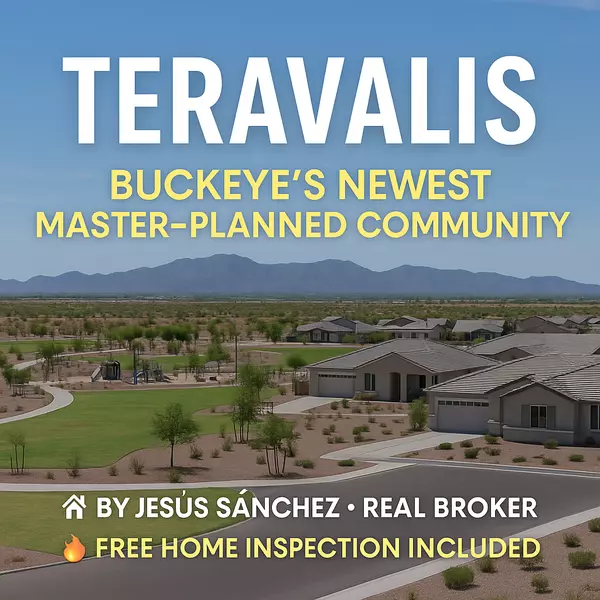

Read More Teravalis in Buckeye, Arizona. The Future of Master-Planned Living in the West Valley

Teravalis in Buckeye, Arizona. The Future of Master-Planned Living in the West Valley The West Valley is exploding with growth, and at the center of it all sits Teravalis, a brand-new master-planned community in Buckeye, Arizona. Spanning 37,000 acres between the White Tank and Belmont Mountain rang

Read More-

📲 Instagram Content Ideas List Location Based Top 5 Reasons To Live In [City] [State] 🏡 The #1 Neighborhood Everyone Wants To Move To In [City] Safest Communities In [City] [Year] 🔒 Hidden Gems In [City] Only Locals Know ✨ [Community 1] vs [Community 2] – Which Would You Choose? 🤔 Lifestyle Focu

Read More The Importance of a Home Inspection

When navigating the real estate market, whether you are a buyer or a seller, there is one crucial step that should never be overlooked: a home inspection. This process is designed to evaluate the overall condition of a property and can provide valuable insights for both sellers and buyers. Let's del

Read MoreHow to Negotiate a Home Purchase

Negotiating the purchase of a home can be an overwhelming process for many buyers. The key to a successful negotiation lies in finding a balance between getting the best deal possible and not losing out on your dream home. In this blog post, we will explore some tips and strategies to help buyers ef

Read MoreThe Pros and Cons of Buying a Fixer-Upper

Are you considering buying a fixer-upper? It can be an exciting prospect, but before diving into this type of investment, it's important to weigh the pros and cons. In this blog, we will explore the advantages and disadvantages of purchasing a property that needs some TLC.Let's start with the pros.

Read MoreTop Home Renovations That Add Value

Home renovations can be a great way to add value to your property, whether you're looking to sell, invest, or build a new construction project. Not all renovations are created equal, though, and it's essential to focus on those that will provide the most significant return on investment. In this blo

Read MoreThe Role of a Real Estate Agent in the Buying

Real estate can be a complex and overwhelming market, especially for buyers who are new to the process. This is where the role of a real estate agent becomes invaluable. A real estate agent serves as a guide, advisor, and advocate for buyers throughout their purchasing journey. They have the knowled

Read MoreHow to Improve Your Credit Score Before Buying Hom

Buying a home is a significant milestone for many people, but it often requires careful financial planning and preparation. One crucial aspect that can greatly impact your ability to secure a mortgage and favorable interest rates is your credit score. If you're currently in the market for a new home

Read More-

The Benefits of HomeownershipReal Estate News, InvestingOwning a home has long been considered a cornerstone of the American dream. It provides stability, security, and a sense of belonging. However, the benefits of homeownership extend beyond these emotional factors. In this blog post, we will expl

Read More The Home Buying Process Explained

The Home Buying Process ExplainedBuying a home is an exciting and significant milestone in anyone's life. However, it can also be a complex and overwhelming experience, particularly for first-time buyers. Understanding the home buying process is essential to ensure a smooth and successful transactio

Read MoreTips for First-Time Homebuyers

Purchasing your first home is an exciting milestone in life, but it can also feel overwhelming and daunting. As a first-time homebuyer, it's crucial to educate yourself on the homebuying process and be well-prepared before diving in. If you're considering taking the leap into homeownership, here are

Read MoreHow to buy and sell a home at the same time

Buying and selling a home at the same time can be a challenging task, but with proper planning and organization, it can be accomplished smoothly. In this blog, we will discuss the different aspects that sellers and buyers need to consider when navigating this process.For sellers, timing is crucial w

Read More-

Closing Day: What to Expect Closing day – the culmination of weeks or even months of searching for the perfect property, negotiating prices, and navigating through piles of paperwork. It's a day that both buyers and sellers eagerly anticipate. As a buyer, this is the moment when you finally get the

Read More -

When it comes to financing a home purchase, there are various options available to buyers. One popular choice among veterans and active-duty service members is the VA loan. VA loans are a unique type of mortgage that offer several benefits to those who have served in the military. In this blog post,

Read More Things to do in casa grande AZ

Casa Grande, offers residents and visitors a vibrant lifestyle with plenty of activities to enjoy. From exploring historical sites to experiencing the natural beauty of the desert landscape, Casa Grande has something for everyone. In this blog post, we will highlight some of the top things to do in

Read MoreHow to get started hosting a Airbnb

So, you're interested in hosting on Airbnb and wondering how to get started? Well, you're in the right place! Hosting on Airbnb is becoming an increasingly popular way to make some extra income. In this blog post, we'll cover the basics of investing in a property to host on Airbnb and share some tip

Read MoreBest way to finance a investment property

Investing in real estate can be a profitable way to diversify your portfolio and build long-term wealth. However, financing an investment property can be challenging, especially for first-time investors. In this blog, we will discuss the best ways to finance an investment property.1. Conventional Mo

Read More-

If you're a prospective homebuyer, you're probably already familiar with the various types of loans available to you. From conventional to FHA to VA loans, there are plenty of options out there, each with their own pros and cons. But have you heard of USDA loans?USDA loans are a type of government-b

Read More -

Arizona is a beautiful state with a stunning landscape, delicious cuisine, and a welcoming community. If you are considering moving to Arizona, here are ten reasons why you should pack your bags and head to the Grand Canyon State.1. Affordable HomesArizona has a fairly low cost of living, making it

Read More

Recent Posts